Irs Tax Brackets 2025 Explained

Irs Tax Brackets 2025 Explained. The irs has adjusted federal income tax bracket ranges for the 2025 tax year to account for inflation. The highest earners fall into the 37% range,.

IRS 2025 Tax Brackets Internal Revenue Code Simplified, 9, 2025, the irs announced the annual inflation adjustments for the 2025 tax year. Tax brackets and tax rates.

Tax Brackets 2025 Irs Chart Corri Doralin, Tax brackets and tax rates. The 2025 tax year, and the return due in 2025, will continue with these seven federal tax brackets:

IRS Sets 2025 Tax Brackets with Inflation Adjustments, As your income goes up, the tax rate on the next layer of income is higher. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

2025 Federal Tax Brackets And Rates Cody Mercie, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ).

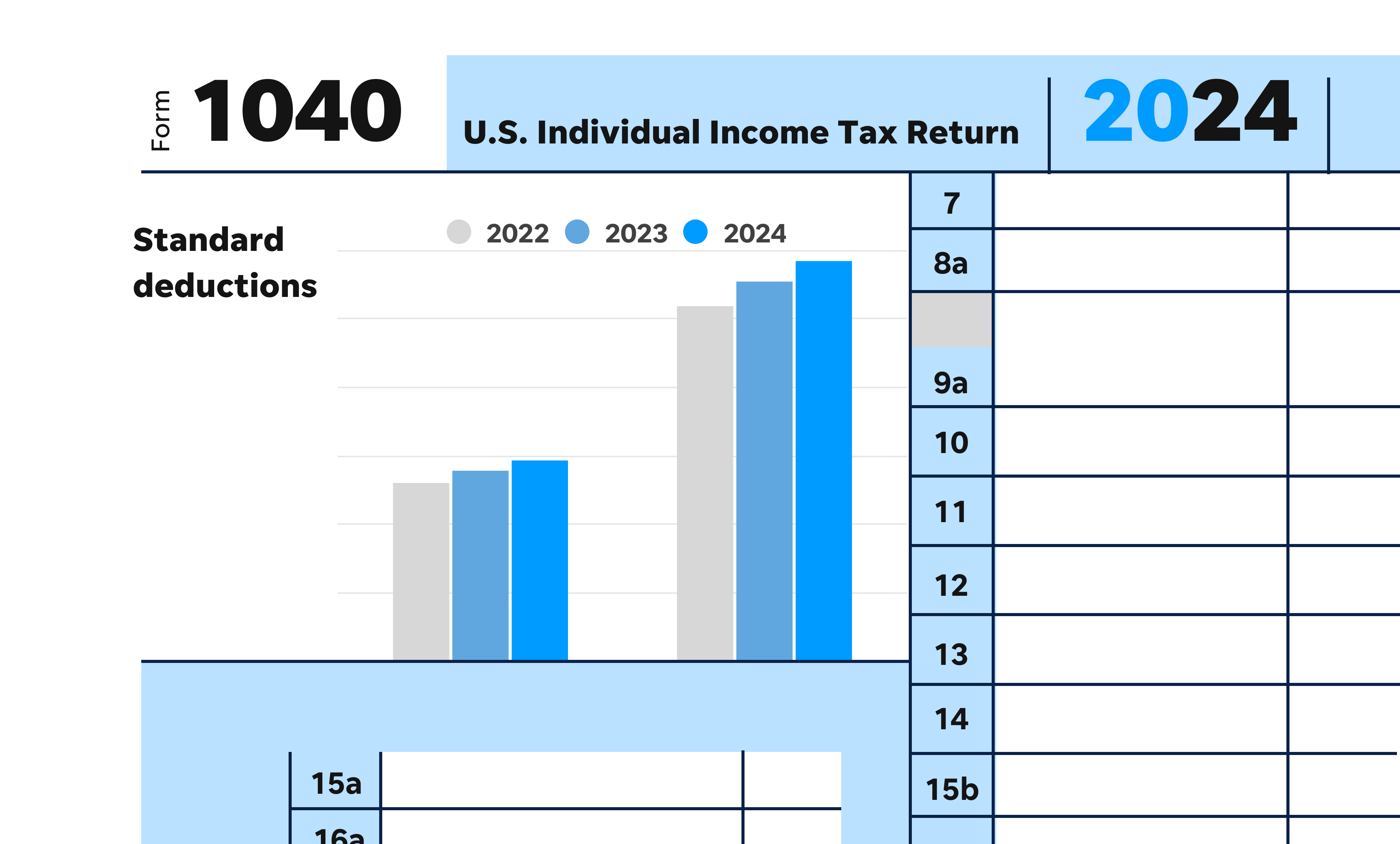

Tax Brackets 2025 What I Need To Know. Jinny Lurline, The irs on thursday announced higher federal income tax brackets and standard deductions for 2025. 9, 2025, the irs announced the annual inflation adjustments for the 2025 tax year.

Tax Bracket Federal 2025 Joete Lynsey, In 2025 are 10%, 12%, 22%, 24%, 32, 35%, and 37%. Income tax brackets for 2025 are set.

What are the Different IRS Tax Brackets? Check City, For 2025, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%. As your income goes up, the tax rate on the next layer of income is higher.

IRS announces new tax brackets for 2025. What does that mean for you?, Here’s how the new brackets will look for single filers and married couples filing. In 2025 are 10%, 12%, 22%, 24%, 32, 35%, and 37%.

Understanding Tax Brackets 2025 Get Informed, Let’s explore the two types of taxes that individuals may qualify for and examine the extent of the changes. The 2025 tax year standard deductions will increase to $29,200 for married couples filing jointly, up $1,500 from $27,700 for the 2025 tax year.

2025 tax brackets IRS inflation adjustments to boost paychecks, lower, The agency has boosted the income thresholds for each. The irs maintains these brackets and adjusts them annually for.